Award-winning PDF software

Form 8379 Online Bakersfield California: What You Should Know

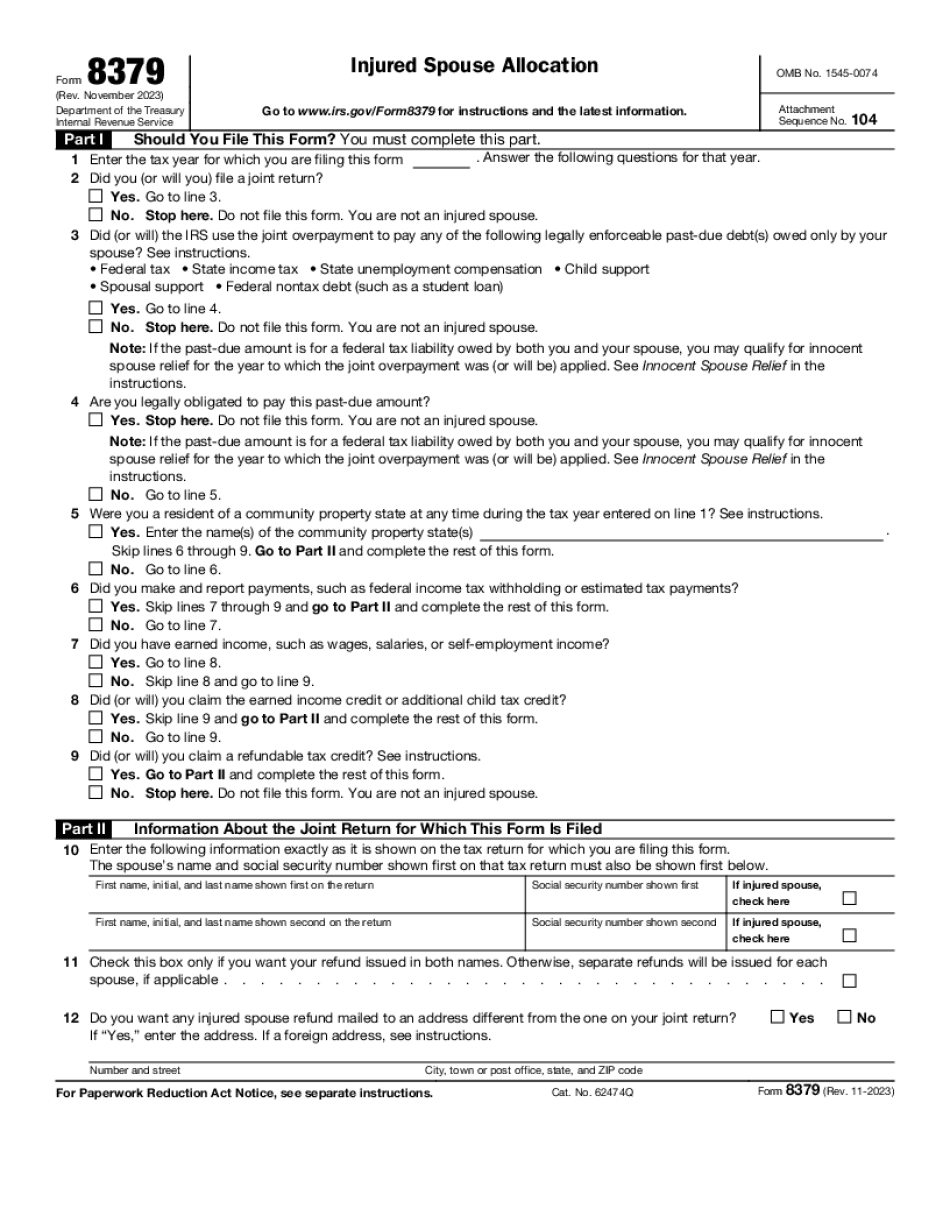

The proceeds of the allocated assets will be refunded to the non-liable spouse. If a spouse does not file an individual Form 8379 Injured Spouse Allocation, the refund amount is then divided among the persons claiming such share of the refund. If the assets are owned by more than one spouse, the allocation is performed per household and the proceeds of the allocation split among all the persons of that household. Injured Spouse allocating the share of the family's refund is an administrative tool for making sure all parties receive benefits from the refund. The allocation is not a court order that imposes a tax obligation. The allocation is based on an objective analysis of the facts and circumstances of the case. When filing a Form 8379 Injured Spouse Allocation with your tax return under the Tax Relief and Welfare Act (TWA) of 1986 to allocate your non-liable spouse's tax refund, the following criteria must be taken into account. 1. The income of any dependents of the injured spouse who lived with the injured spouse at the time of the injury. 2. Any taxable income attributable to income earned by or held by the injured spouse, if applicable. Any taxable income that is attributed to assets owned by an injured spouse by a non-liable spouse under paragraph (a) or (b) of this section. 3. Any state and local taxes and fines which the injured spouse would have been required to pay under the provisions of the TARIM Code if he/she were an insured (or “taxpayer”). 4. Any State income tax return filing penalties that the injured spouse would have been required to pay under the provisions of the TARIM Code if he/she were an insured (or “taxpayer”). 5. Any other income (including interest, dividends, rental income, compensation, retirement benefits, or annuities) that the injured spouse could be required to pay. In most cases only the taxable portion of income that is attributable to the injuries to be allocated by a non-liable spouse shall be allocated. This section refers to the injured spouse and the non-liable spouse in the same situation. For example, if a casualty-damage fee of 25 is assessed against a casualty loss of 1,000 that the injured spouse would have been liable for, but is not attributable to the injury, his/her share is 50 of the 75.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8379 Online Bakersfield California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8379 Online Bakersfield California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8379 Online Bakersfield California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8379 Online Bakersfield California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.