Award-winning PDF software

Phoenix Arizona online Form 8379: What You Should Know

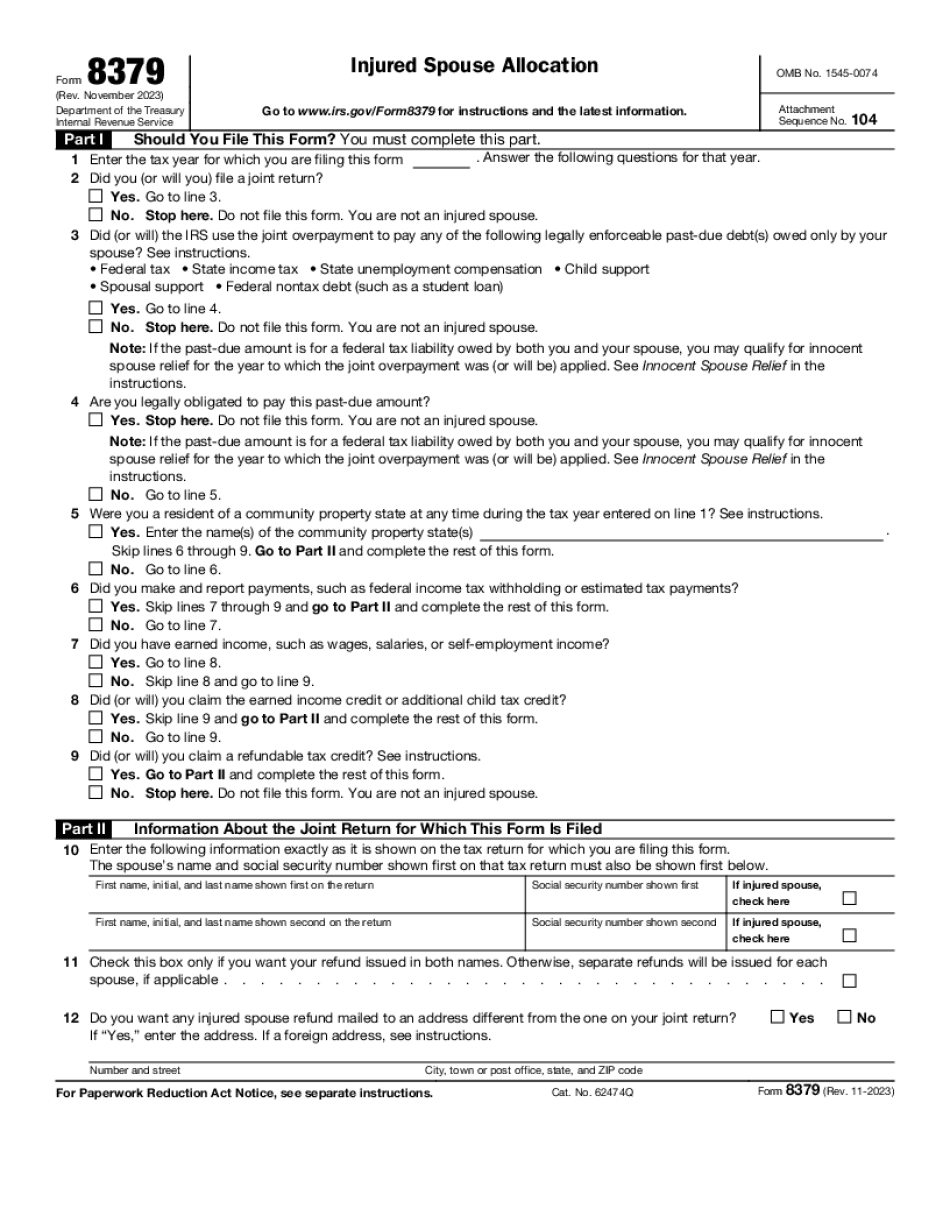

For Businesses With Smaller Profits The IRS offers financing for you and your employees. Our loan and refinancing program offers both private and government loans, and allows you to borrow only the actual cost of property (as opposed to capital losses) on which a reduction in tax liability could be made. For information on the federal Tax Refinancing Act, call our help desk at. Do I have to pay my spouse tax on a gift received from a charity? Yes. You may deduct from your taxes those gifts received by you from an organization (such as a charity) on which the IRS has allowed a deduction for contributions that the organization makes to qualified groups or activities. When you make these gifts to your spouse, be sure to give your spouse an IRS Form 1099-G giving his or her address. Can I deduct child support from my federal, and state income tax return? No. The deduction for child support must be given to the parent for the child, not to the IRS. So, for example, your tax return must show you are liable in order for the IRS to have jurisdiction to enforce your child support obligation. If your spouse is married and the child support obligation is due to each parent, then he or she may claim the deduction as a deduction on his or her federal income tax return. What is the difference between the two forms? This is the new Form 8379-R. The new Form 8379-R is for taxpayers who were injured when filing as a married couple. For injured spouses, the form 8379 has been streamlined and has been renamed Form 8379-R, Injured Spouse Allocation. Form 8379 (Rev. November 2021) — IRS A refundable tax credit that can be used for: Injury or death due to an injury, illness, or disease; Loss of income, job, home, or retirement benefits due to an injury, illness, or disease; Property that was purchased due to loss of income as a result of loss of income from injury, illness, or disease; Award of a temporary disability allowance, pension, life insurance, pension or survivor pension paid on behalf of an employee; For purposes of determining the amount of the credit: Injured spouse means a taxpayer whose spouse died in an accident. Spouse generally means a spouse who is legally responsible for the support of the taxpayer's child.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Phoenix Arizona online Form 8379, keep away from glitches and furnish it inside a timely method:

How to complete a Phoenix Arizona online Form 8379?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Phoenix Arizona online Form 8379 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Phoenix Arizona online Form 8379 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.