Award-winning PDF software

Form 8379 for Vacaville California: What You Should Know

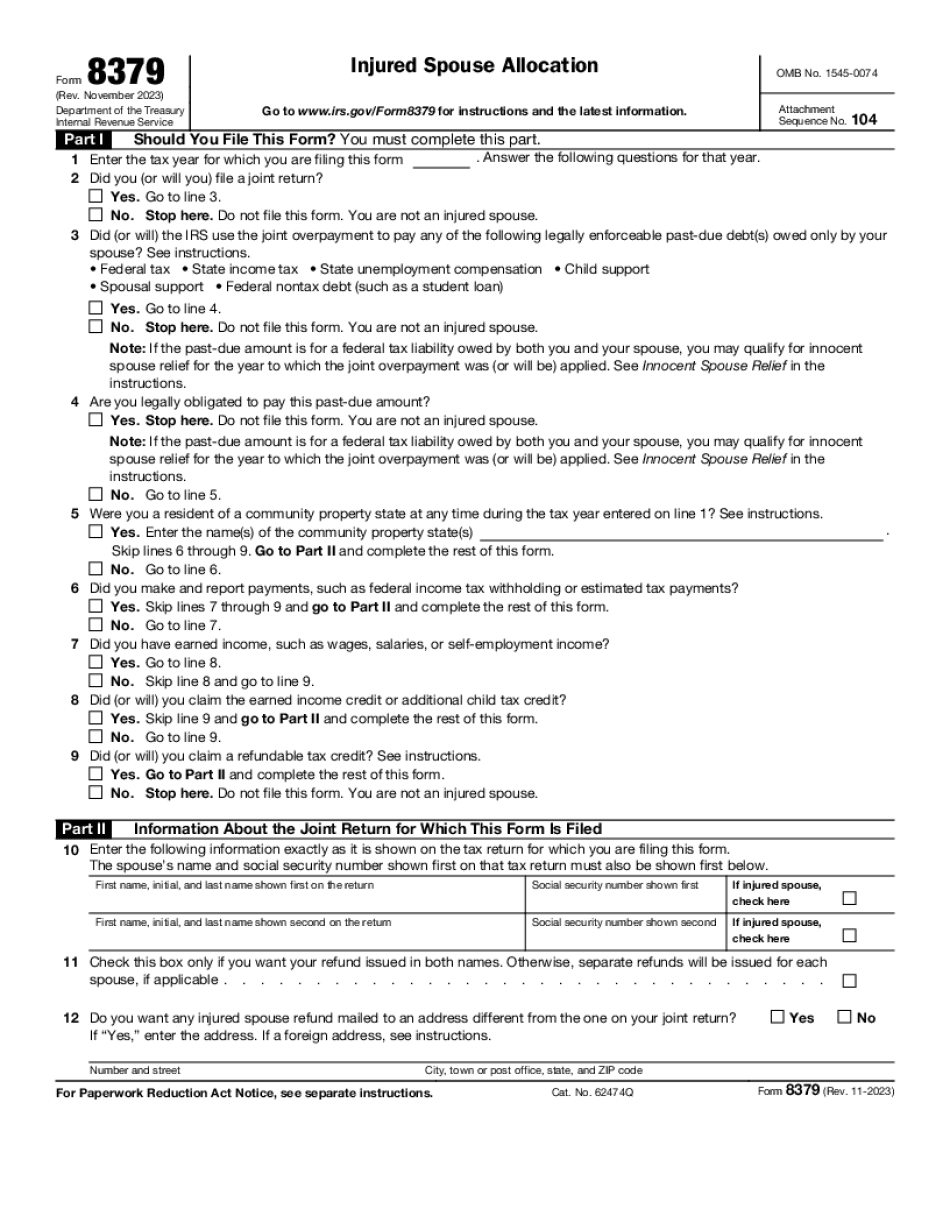

Your name, address, Social Security number and spouse's name and address must match the address/ Social Security number (and the same as on the joint return) on the injured spouse's tax return. Form 8379 may include a statement from the injured spouse. Injured Spouse Tax Refund Allocation Request or Claim. The injured spouse is not allowed to claim a refund of the overpayment. If the IRS has a copy of your Form SSA-1099, a letter or check from the injured spouse can be submitted along with the Form 8379, with a request that the injured person be allowed to claim a refund of this overpayment. (However, it may not be accepted because the injured person is not the same person who would have applied for an SSA-1099, which is only available to taxpayers who filed income tax returns for the tax year that is 10 years after when the injury/condition occurred.) Include a copy of the SSA-1099 letter (if offered) and a copy of the taxpayer's letter that signed the joint claim. Dec 16, 2025 — If the IRS is required to seize an overpayment to pay for an injury (including death), the IRS can choose to either accept it as refund and return it to the injured spouse as ordered, or send it to the person claiming the overpayment. If the IRS accepts the overpayment and sends it to the payee by mail, the payee must sign the letter stating this and must deliver or mail to the injured party at the address specified on the letter. The injured party has three weeks (until the deadline set forth for the mailing) to sign the letter. A Form 8379 must be submitted along with the letter. For the payee's signature, it must be written clearly above the person's signature of the payee. (See examples of signatures of the payee and the payee's signature). The payee must sign the entire letter before the payee signs the payee's copy. (For this reason, it is not a good idea to sign “No.” on the “payee side.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8379 for Vacaville California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8379 for Vacaville California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8379 for Vacaville California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8379 for Vacaville California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.