Award-winning PDF software

Form 8379 Elizabeth New Jersey: What You Should Know

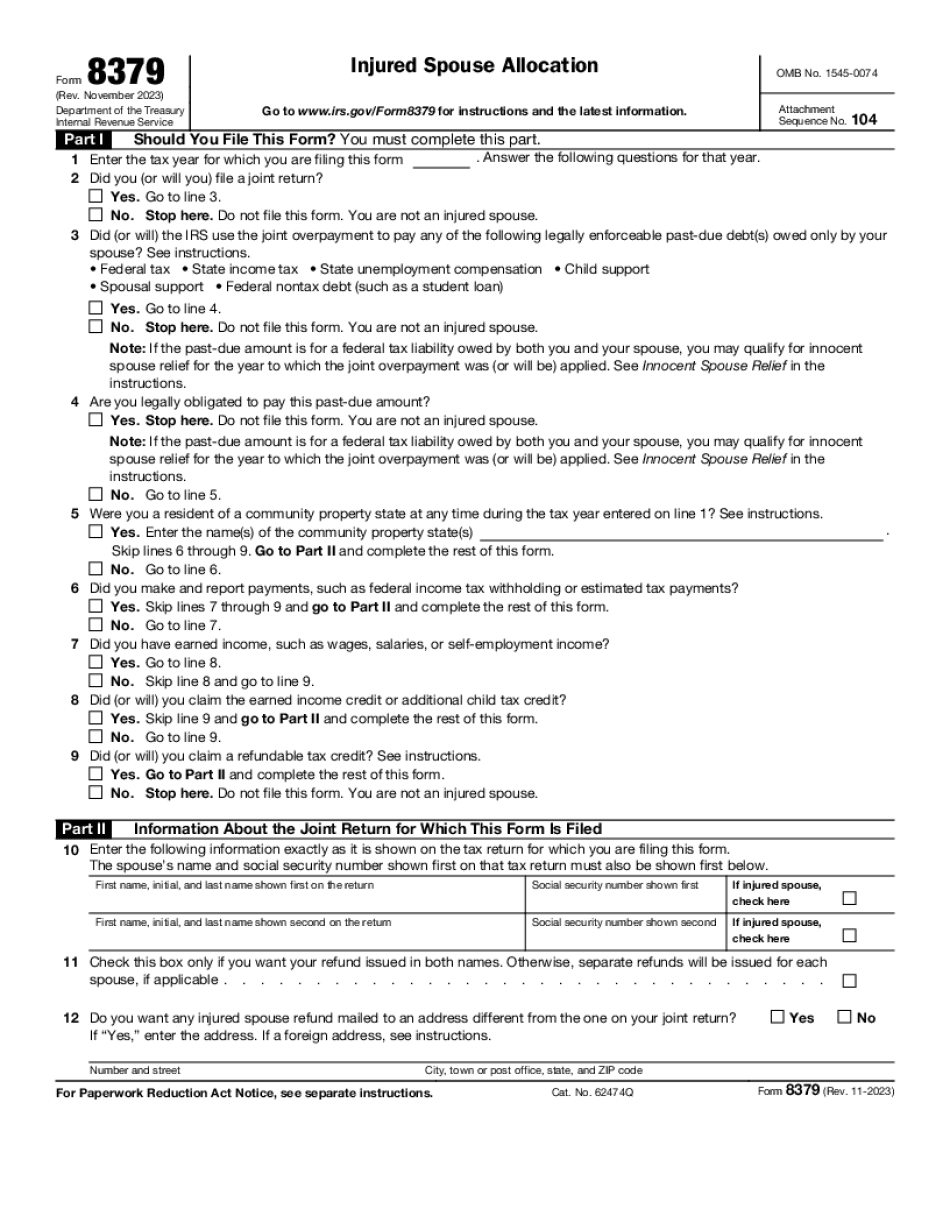

The IRS can seize your portion of any cash or savings account with a balance less than or equal to the debt owed. In general, the IRS cannot seize someone's salary, interest, capital gains, or dividend proceeds because those are taxable income. The IRS is only allowed to seize wages, tips, and other taxable wages that are withheld by an employee or from the cash value of your employer's payroll deductions (such as social security, Medicare, wage insurance, and unemployment compensation) if you owe the IRS taxes or a tax debt. What Happens with Injured Spouse Allocation — IRS If an injured spouse on a jointly filed tax return files Form 8379 in person, it is mailed to the IRS Service Center in your state where you filed the return. If you file Form 8379 via mail, it is sent to: Injured Spouse Allocation — IRS If you sign this form, you give up your right to a share of the joint federal tax refund when the overpayment is applied to a debt owed by the other spouse. The injured spouse must not file an amended return. If you do not receive Form 8379, send the IRS your mailing address and an email address when the IRS has your return and the amount of the overpayment. Send a photocopy of your driver's license or other government-issued photo ID, so you have proof of residency. IRS Service Center: Email the address listed on the bottom of Form 8379 (not an e-mail address that you have ever used) A copy of the Form 8379, including your signature, cannot be received by the IRS more than 5 years after it is filed.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8379 Elizabeth New Jersey, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8379 Elizabeth New Jersey?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8379 Elizabeth New Jersey aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8379 Elizabeth New Jersey from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.