Award-winning PDF software

Form 8379 Online Oregon: What You Should Know

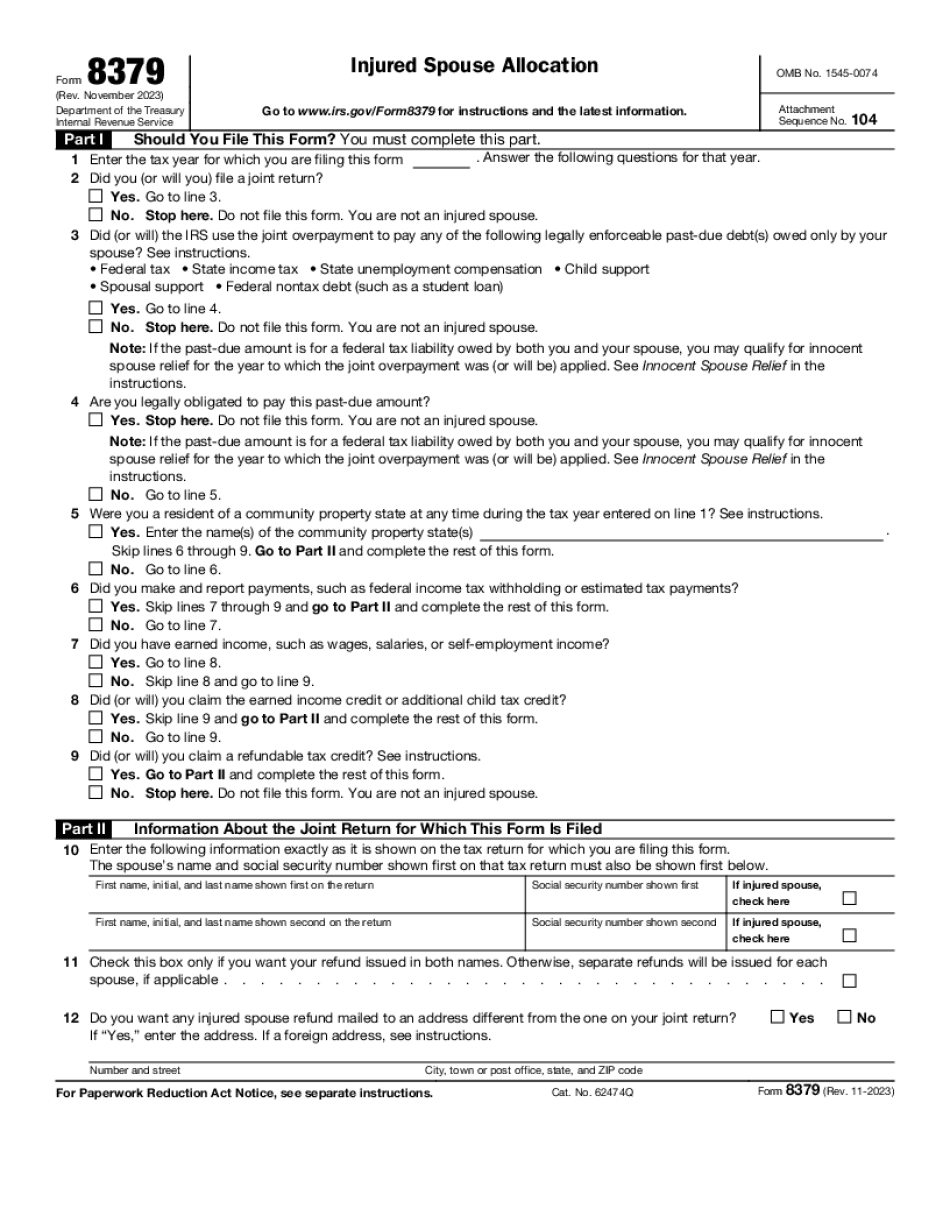

Injured Spouse Allocation is a special tax form that provides you with an equal allocation of your survivor benefits if you or anyone you care for are the beneficiary of a death (deceased) benefit under the Social Security Act and are a dependent-child of yourself (your spouse) or a dependent-child under your spouse's Social Security Act eligibility for benefits. To claim your injury or death benefits on your Oregon Form 8379, click here Form 8379 is a very specific, single, one of a kind, non-adjustable income tax refund claim made to help an injured spouse or partner who is claimed as a dependent-child by the Social Security Administration (SS) only. The claim is used when Social Security does not have any tax records or a tax return on file that lists you as a dependent of another person who died. It is filed by a dependent-child who: Is not a U.S. citizen Is not a legal resident alien Is not under 18 years of age or under 50 years of age as of the earliest date of death claimed on the recipient's Federal or Oregon Social Security benefit claim. Your claim must include the date, cause of death, and the benefit-earning parent(s) of the deceased beneficiary as well as: If no beneficiary is known, each qualifying child. If a qualifying child is unknown, you must identify the child by one of the following: The name of the child in the records of your social security administration, such as a birth certificate, driver's license, or school record Full name of the child in the records of Oregon Child and Youth Services (CDs) — please contact CDs. You must also specify the date of death or date upon which it was certified as valid by the appropriate authority (e.g.” I/my child” on an application for a driver's license, etc.). Your claim must include the name of the beneficiary and the Social Security account number, if known. It does not need to be the account number of your spouse's retirement or pension account. The beneficiary can be a surviving parent, stepfather/mother, brother or sister, or other individual listed on the beneficiary's tax return. If no beneficiary is known, we ask that you provide the name and account number for the Social Security account on which your beneficiary would have received benefits, including benefits earned while you were a recipient and/or survivor.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8379 Online Oregon, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8379 Online Oregon?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8379 Online Oregon aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8379 Online Oregon from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.