Award-winning PDF software

Savannah Georgia online Form 8379: What You Should Know

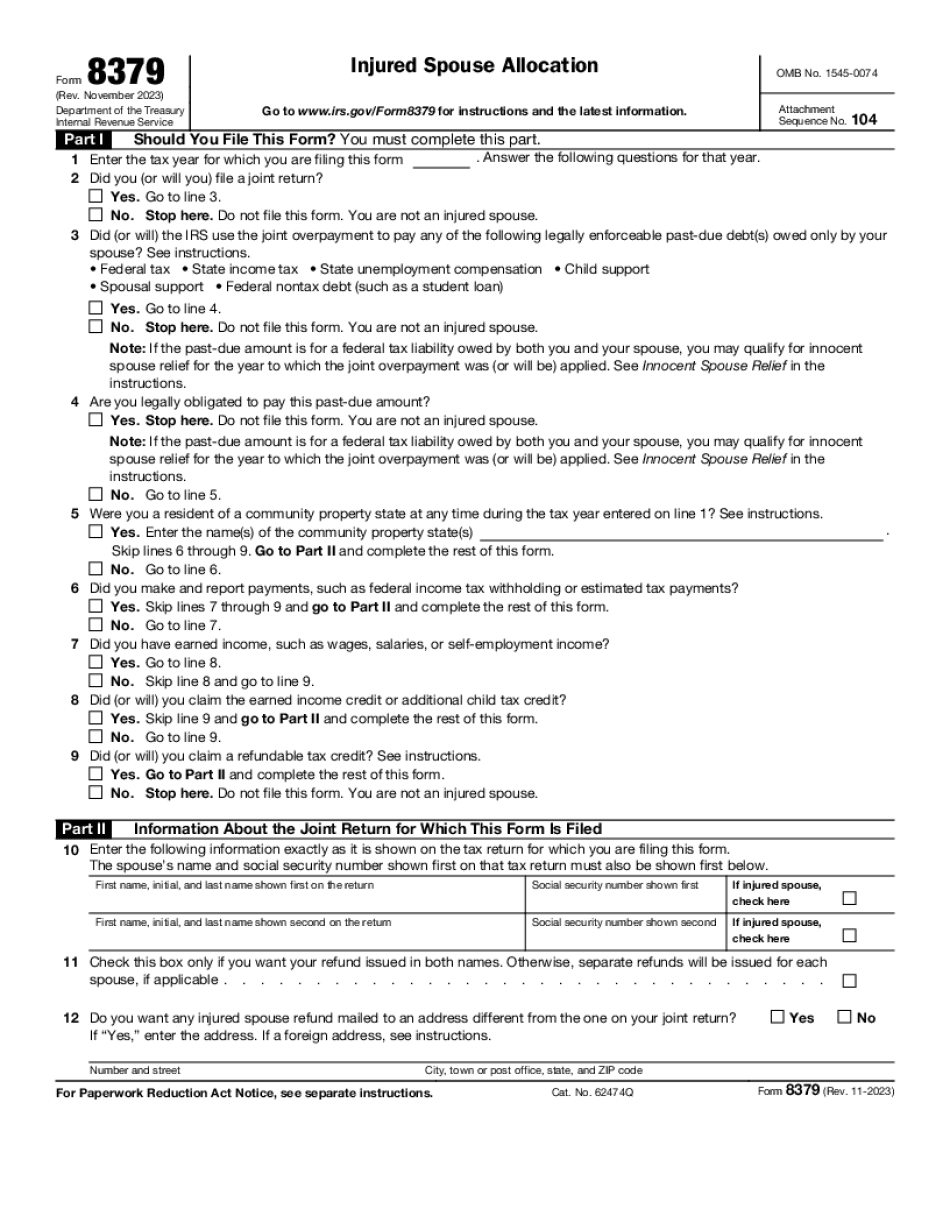

If there is no link to pay directly to your utility company, click here instead. I'm sure you are asking, 'How do I file my injured spouse tax return if I'm filing on my own? First, determine if your injured spouse is your dependent. I believe this is fairly straightforward depending on the extent of the injury and the type of injuries. Second, contact a qualified state-licensed disability attorney to advise you about filing a joint statement (Form 8379). I believe it's the only way for you to have any chance of winning your back tax bill if you are the injured spouse on your joint filing. Note: If you were married to the injured person and are considering filing joint tax and/or credit returns, then don't forget — you'll want to pay attention to how your tax return is handled with Form 8379 and Form 8379-R because each will have their own requirements for you to meet. For example, in the situation of an injured spouse who is the dependent of a joint return, the tax benefits you'll gain from joint returns will be reduced compared to individual returns (and combined returns will have reduced benefits). If you are interested in learning more about Form 8379 and filing jointly, you can contact a qualified State Tax Attorneys and their offices via: Contact Us on the Legal Aid website, call (TTY, TTY Relay), or chat online on chat.Arizona.edu (you can also access chat by using the keyword Tax Attorneys). Get Free Help | Legal Aid of Arizona or chat online with Legal Aid Arizona at chat.Arizona.edu or go to the website's Resources page. If you are not a resident of Arizona and are interested in reading more about injured spouse filing and taxes, I suggest you read about the importance of filing injured spouse taxes for your personal situation. What would happen if you don't pay taxes on your share of the joint tax return? First, your IRS tax bill will be delayed, if not reversed, and you'll find yourself on the right side of the line in your federal income tax return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Savannah Georgia online Form 8379, keep away from glitches and furnish it inside a timely method:

How to complete a Savannah Georgia online Form 8379?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Savannah Georgia online Form 8379 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Savannah Georgia online Form 8379 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.