Award-winning PDF software

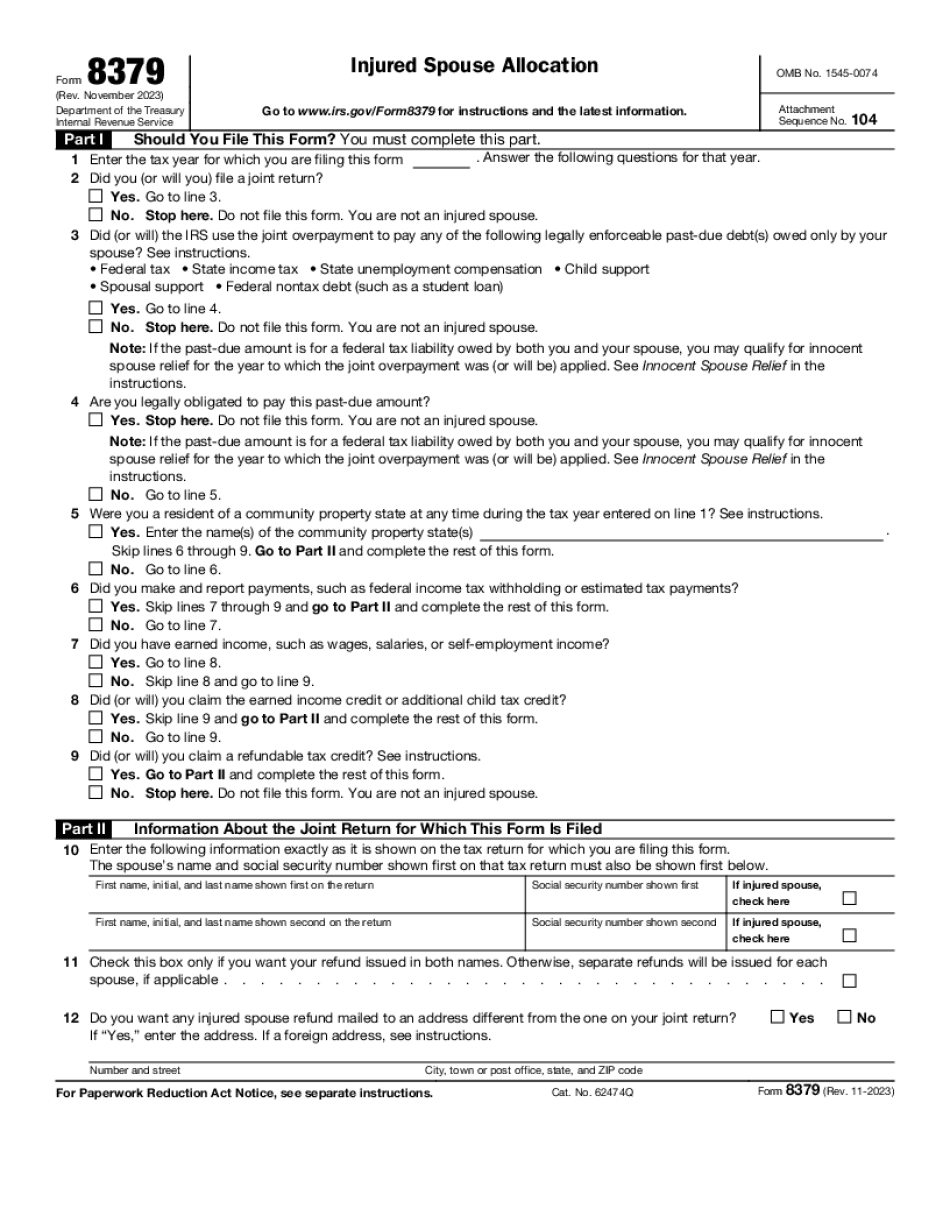

Printable Form 8379 Round Rock Texas: What You Should Know

But be careful! The paperwork is for an IRS office just outside your town and state. Check your local government website for that office. If the name isn't listed in that site, go to the IRS site. Use its search tools. See: • Print out all the Form 8379 forms, including those for child support and dependent care, and send them to the IRS. • Have all the W-2 and 1099-R forms available for your computer. Your employer gives you these papers in January. But make sure your employer knows that you need them to file your taxes. You must file. IRS Form 8379 — Not Your Fault! If you receive this form from the IRS or anyone else because you didn't file, and you didn't owe it, then you have nothing to worry about. It's your fault, and it's not the IRS's. Is IRS Form 8379 for you? Fill out IRS Form 8379 as instructed above and print out your blank form before you pay your taxes. You can download free documents for your federal taxes. The PDF forms are the preferred ways to get the documents you need. Fill out forms in person, download, or mail them. Don't lose them! IRS Form 8379 — Not Your Fault! This is your form. The IRS needs it. Do this! The IRS has you — now how many more things can they seize — your savings, your homes or businesses? IRS Form 8379 is here to protect the innocent and to give every taxpayer a fair chance to make their fair share to Uncle Sam. This form helps you file. Here you must report a change in income, gain, loss, deduction, credit, or exemption. If you receive this form for any reason, do not ignore it. The IRS has information that it needs to verify. If information is missing, or you don't know how old the tax return you have, you will need to amend your taxes. If you are claiming child care assistance, this form also confirms to the IRS that your child is dependent on you. If you want to know when you will get paid, use Form 8949. The IRS can ask you about an accounting error when you first got a refund or notice. You don't have to pay the penalty now. If your Form 8379 is for you: • Fill out the form and submit it to the IRS. You did the IRS duty and filed your tax return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8379 Round Rock Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8379 Round Rock Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8379 Round Rock Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8379 Round Rock Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.