Award-winning PDF software

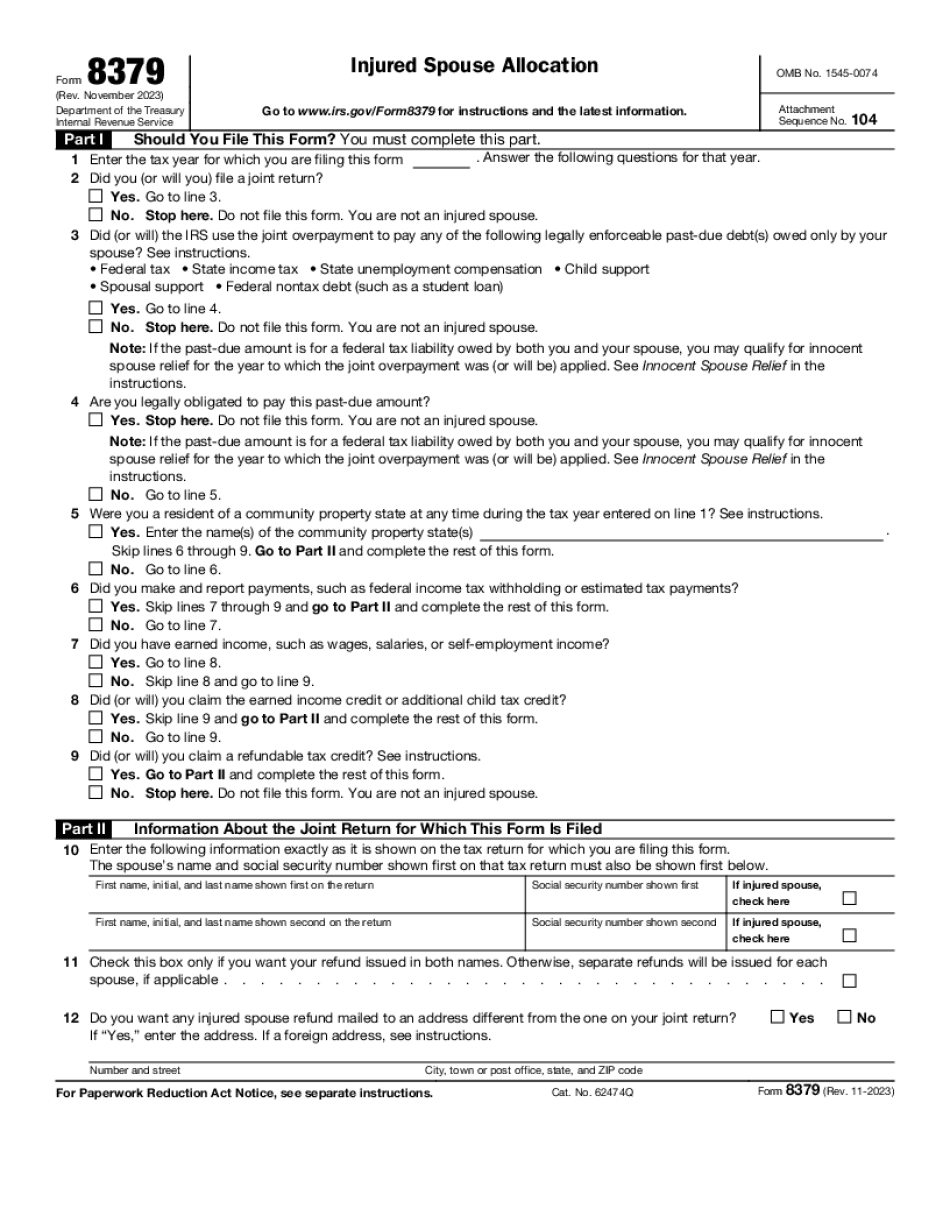

Printable Form 8379 Portland Oregon: What You Should Know

In addition, you must pay back the child support payment in full, plus an extra 6% (the tax withheld from the child support payment that is greater than 12% of the amount you paid). This is called an Injured Spouse Relief | AndreTaxCo, LLC Injured Spouses Relief, Form 8379, is filed for each tax year to be considered, and the IRS will not accept any new applications. The maximum tax liability for each dependent child is 25,000 and for each support obligation is 2,500 (whichever is greater). If you pay any child support and the IRS decides you cannot be assessed more than 2,500 per claim, then you will receive a refund of that overpayment. The amount of the refund is based on the actual amount of your overpayment plus 12%. If you do not satisfy the requirements, you will receive a 2,500 penalty. A copy of the Form 8379 for your year of determination is attached. You may file for an adjustment of payment. If you are having problems making payments, contact the toll-free number above to speak with a tax professional. Injured Spouse Relief, Form 8379, can be obtained without filing an 8379. The IRS is now also publishing a pamphlet online about Forms 8379. The How to File Form 8379 If you are required (under the law) to file a tax return, and you are not receiving federal payments, you must file a tax return or pay the tax. You will usually be required to pay the tax if you qualify to receive it, you filed a tax return, and you paid the tax. If an IRS officer or another representative demands' payment, then the law provides that the person must first give you a Form W-2 or other written statement that describes the amount of the payment. The officer must then explain to you the reason that you are not required to file a claim. The statement will specify whether any other governmental program payments or payments to other government services, and other government payments, would affect your ability to file a claim or whether the payment was specifically made to you. The statement may also be used to help you figure out whether you are able to file a return. There are three possible reasons why someone is required to file a tax return and to pay the tax.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8379 Portland Oregon, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8379 Portland Oregon?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8379 Portland Oregon aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8379 Portland Oregon from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.