Award-winning PDF software

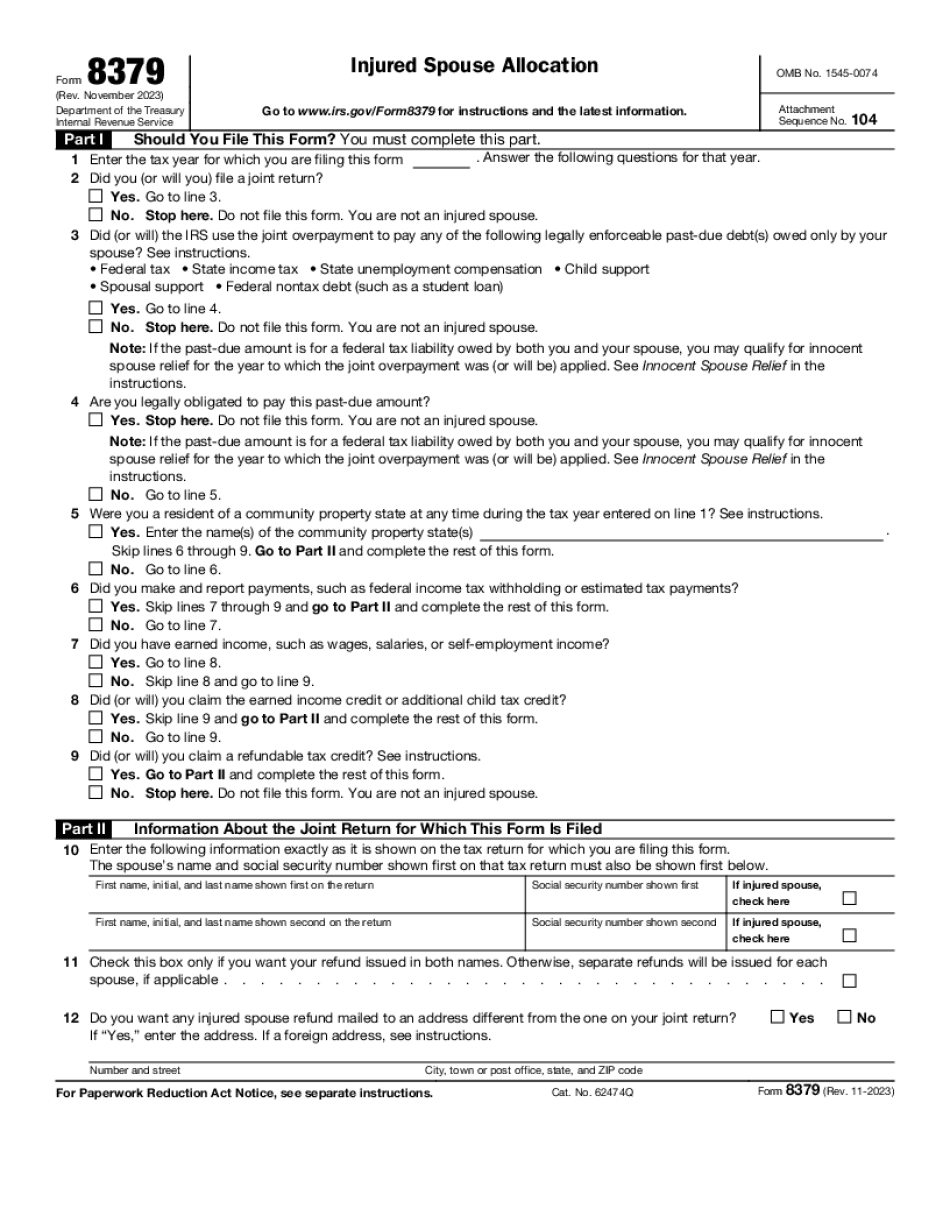

Printable Form 8379 Palmdale California: What You Should Know

He or she can file Form 8379 to claim the refund, or request to have it allocated to him or her, or both. “Injured” is not to be confused with “injured spouse,” as you will explain in just a bit. To figure the amount for the injured spouse, you do two things. The first thing is to find out whether you have an eligible spouse. If you have an eligible spouse, you will just take the amount of your “gross income in the year immediately preceding the year the divorce decree is entered,” as shown on your original divorce decree. That is, figure out the “gross income” (incomes less expenses) from your eligible spouse, and subtract any allowable expenses from that. If you have an ineligible spouse, this is more difficult because you may only get as much as you were legally entitled to have. Your eligible spouse can be a spouse: · living in your marriage and who is either: a) still legally married in your marriage, or b) legally separated with your consent or by court order at the date of your divorce, or c) living with a current spouse who is either: a) legally separated from him or her and living with you because he or she is your spouse, or b) separated with your support or not living with your spouse for any of the following reasons: · child custody, financial support, or marital support a) you are the father, mother, brother, sister, or person legally or legally adopted by your spouse, or b) you are the person legally or legally adopted by your spouse, and you live with an eligible spouse and were born as the result of a relationship with that spouse or adopted, or c) you are the person legally or legally adopted by your spouse. What about your ineligible spouse? You don't know how much your ineligible spouse gets. It could be the amount it was entitled to have. What you do know is that your spouse is legally entitled to have that amount of money. The next step is to estimate the “gross income” in the year immediately preceding the date the first marital payment was received by the court. The court will determine what the “gross income” is. To figure that number, you divide the total income you received for the year — your spouse's, your spouse's children's, or your children's income (and any applicable deductions) — by 12 months. You don't have to keep every single penny of every paycheck.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8379 Palmdale California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8379 Palmdale California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8379 Palmdale California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8379 Palmdale California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.