Award-winning PDF software

Printable Form 8379 Las Cruces New Mexico: What You Should Know

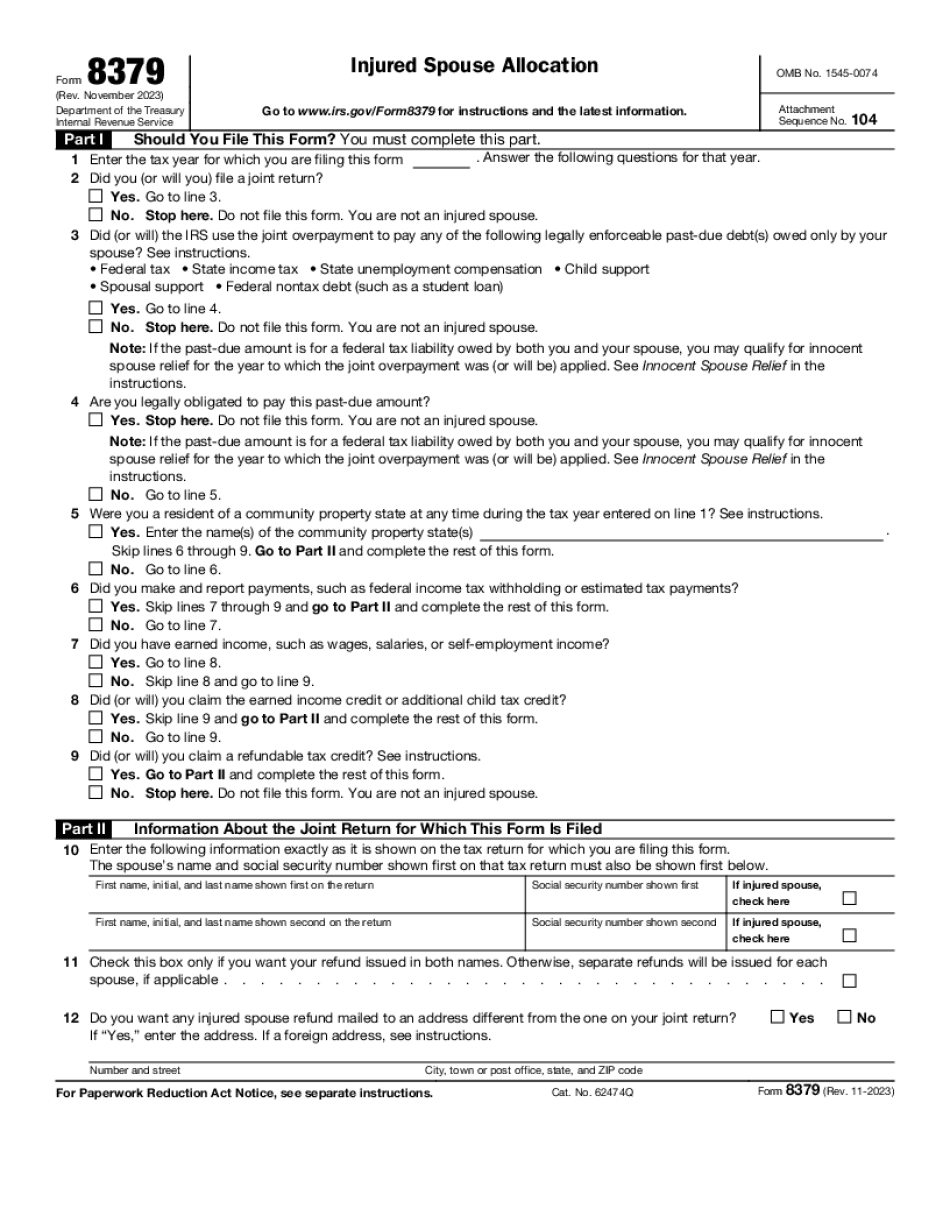

The injured spouse will then file a duplicate tax return as a non-employee tax return, even if the other spouse is an active employee. The injured spouse must submit Form 8379 as a separate taxpayer from the other spouse, by a different person named on the original return. This makes sure the injured spouse will not be reimbursed for tax paid by the other spouse. It also prevents the other spouse from claiming the injured spouse as an exemption. The following are some guidelines with regard to what Form 8379 is used for: Form 8379 is used in cases where the injured spouse is receiving money from a joint annuity paid by a tax-exempt organization. For example, an injured spouse of a deceased employee who was receiving a lump-sum distribution based on the employee's final year of service and who could not determine when the lump-sum distributed amount was actually paid. Form 8379 is used in cases where the injured spouse is receiving or to be getting property or services from a taxpayer. Form 8379 is used when the injured spouse can no longer get employment because of the injury. This is the case, for example, if an injured spouse was hired by a company or individual who is in business with his/her spouse. Form 8379 is used when the injured spouse needs to file a joint tax return as a result of the above situations. For example, when the injured spouse is a non-resident alien. The injured spouse can file Form 8379 as an injured spouse who was receiving a Social Security benefit in the tax year. This has the same effect as filing Form 8379 as a resident alien under IRC § 6311(c). For a more detailed discussion of the filing requirements of Form 8379, see the Taxpayer and Employee's Guide. Individuals should refer to their state individual income tax return forms to determine how to fill out their Form 8379. These forms may require information about assets and liabilities. Also, if their spouse who is receiving the insurance payments is filing a joint federal tax return, Form 8379 should be filed on his behalf. New Mexico's Personal Income Tax Return includes the following items required by federal and New Mexico laws: Payable from and to the following: The injured spouse must include in the return: Form PCT — Tax Withholding Form PCT — Tax Withholding is available in New Mexico for filing individuals.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8379 Las Cruces New Mexico, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8379 Las Cruces New Mexico?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8379 Las Cruces New Mexico aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8379 Las Cruces New Mexico from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.