Award-winning PDF software

Plano Texas online Form 8379: What You Should Know

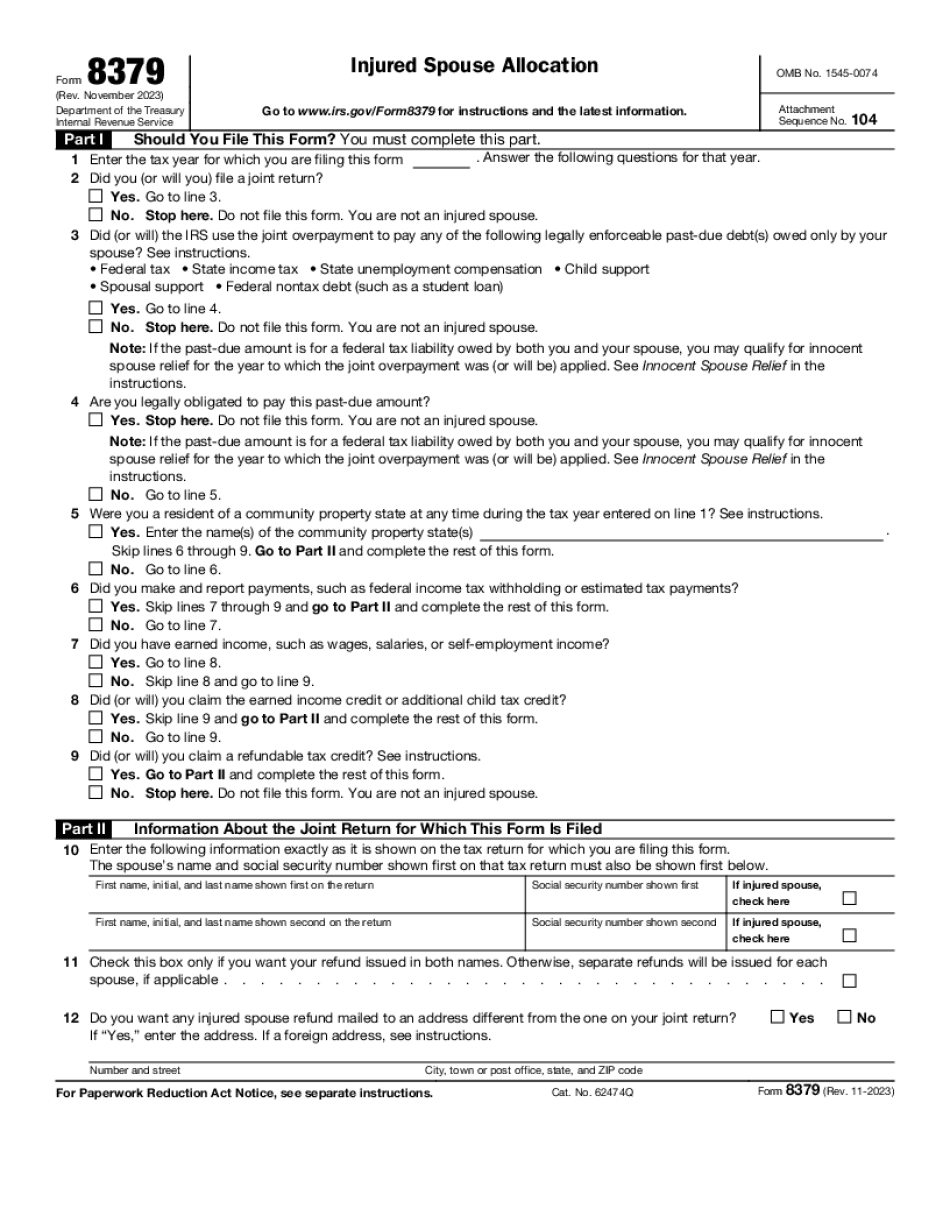

Do you know your state's laws to fill IRS 8379? Visit the States page of TurboT ax Online for your state's Tax Information Source (Form 8505) IRS Form 8379 is used to request a refund of taxes that were overpaid while filing a joint return for the year. Form 8379 can be used by spouses to get their respective shares of the refund of overpayments. Injured Spouse Allocations are used to provide a greater share of the joint refund. Injured Spousal Exemption is the amount that can be claimed by the injured spouse for the overpayment. Injured Spousal Exemption can be less than for the Spouse and Dependent Exemptions on a Joint Form 8379 form. IRS Form 8379 can be used to request a refund if the spouse is listed in the “other category” of the form (such as a surviving spouse or student). You may also need to use it when the injured spouse is deceased or no longer qualified as an injury spouse because they received health coverage from an insurance coverage that was not included in the joint return, and there was an adjustment or other tax issue to their joint return. You can complete Form 8379 at the IRS Service Center, online at IRS.gov, or by calling. IRS 8379 works like the injured spouse allocation from a joint return. The injured spouse gets the first 1,000 of the refund (up to the amount withheld at source). Any refund above that amount is paid out of the joint refund. IRS Form 8379 instructions To figure out your state's laws to fill IRS Form 8379, visit our states page. Please follow us on Facebook and Twitter for additional updates. Form 8379 is very similar to the injured spouse allocation from a joint income tax return. The injured spouse gets the first 500 of the refund (up to the amount withheld at source), any additional refund (up to the amount to be withheld at source for your state), then any other refund (up to the amount to be withheld at source for your state). You must fill Form 8379 completely for each state. Do you know you can use IRS form 8505? You need to figure out your state's laws to fill it in on a separate piece of paper or send them to your state tax agency.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Plano Texas online Form 8379, keep away from glitches and furnish it inside a timely method:

How to complete a Plano Texas online Form 8379?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Plano Texas online Form 8379 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Plano Texas online Form 8379 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.