Award-winning PDF software

Form 8379 Online San Antonio Texas: What You Should Know

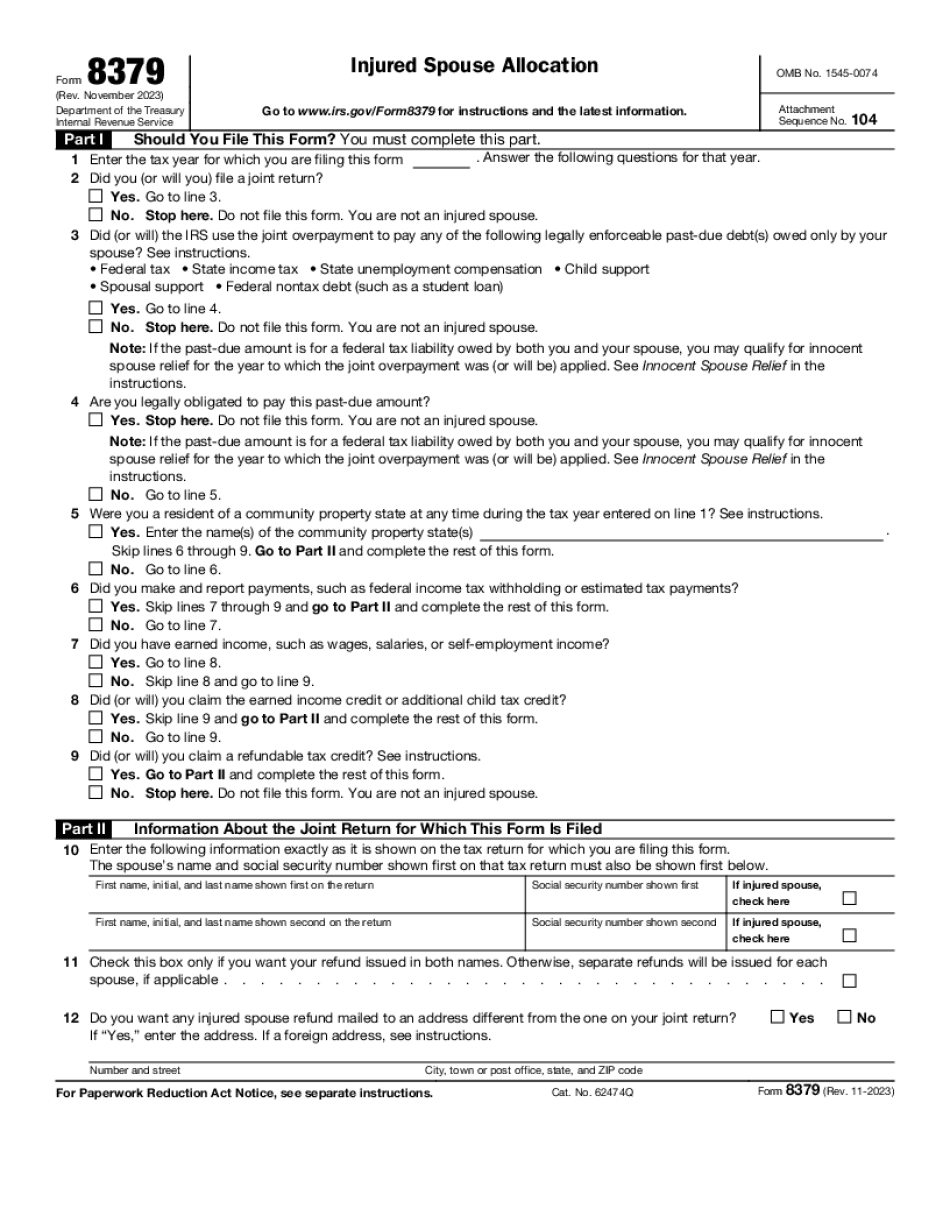

Required information. Please note: the required information is not the same for each return, just the information included in the form. b. Statement of reasons for the request. Note: the statement of reasons for the request must include at least a general description of the circumstances of your failure to claim the refund. The statement of reasons may be included in Schedule A to the Form 8379 with the other information required by paragraph (c)(2) of this section. c. Contents of the request. To be considered, you must complete An explanation for your failure to claim the refund. This example shows what you could enter in your request. The request should say: It is against a good faith belief that you are not entitled to a refund, or you were incorrectly assessed or estimated the tax. You may want to include a copy of this letter on the Form 8379. d. Taxpayer identification number (TIN). Your TIN is the 5-digit number assigned to your taxpayer identification number on your current tax return. If it is not on your current tax return you may be able to get it by calling, or go to and complete a paper request in which you write to the IRS at the following address: Cincinnati, Ohio 44240 Note that you may also be eligible to get information about your eligibility for an IRS Form 1099-INT. e. Date. You must sign and date your request no later than May 1, 2022. This is the date from which any tax or refund can be applied. In the case of a request from an injured spouse who claims that you are obligated to pay back arbitrages under a marital property agreement, that fact may be a legally enforceable debt. In these cases, the injured spouse may be able to get back his or her share of the refund by completing Schedule A and submitting it to the Department on or before the date indicated in the line number in Schedule A. f. Mailing address. Send your request using the mailing address specified above. g. Payment. You must provide the payment within thirty days after sending the Form 8379, either by depositing it in the IRS Federal Reserve Bank, or by paying your installment on a credit card. You may pay by the check or cashier's check, by electronic transfer of money over the Internet or by credit card.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8379 Online San Antonio Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8379 Online San Antonio Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8379 Online San Antonio Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8379 Online San Antonio Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.