Award-winning PDF software

Form 8379 Houston Texas: What You Should Know

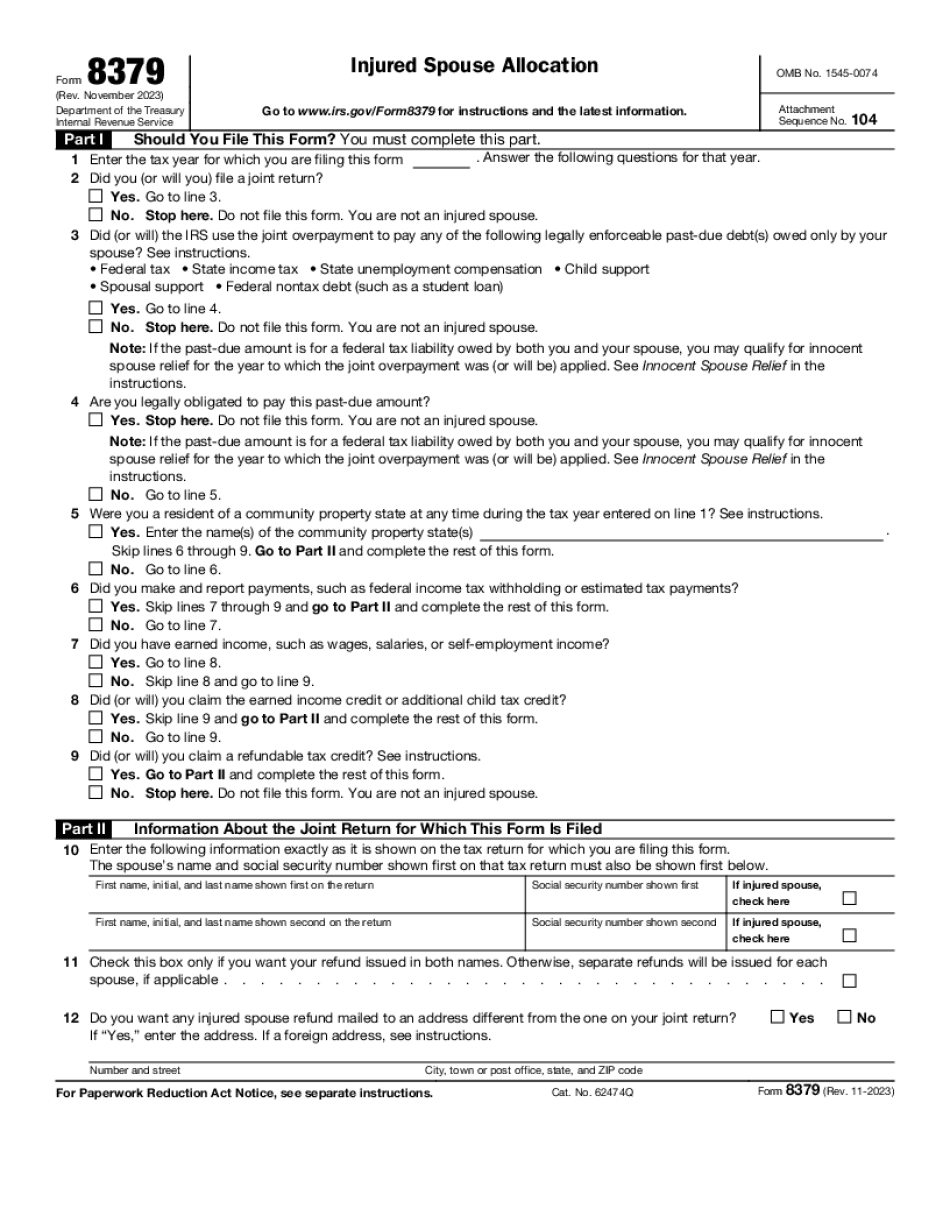

The Form 8379 application must be filled in or faxed in to us. We offer financing on our services as well, it is called a Tax Deduction Financing Plan. The details are provided in the form, it says “Injured Spouse Allocation Agreement”. The IRS Form 8379 will ask for information about the injured spouse and the amount of the overpayment. Once we have received the form, we take care of a lot for you by providing the following assistance: To be eligible for Injured Spouse relief, the injured spouse must show that he or she suffered damages as a result of the taxpayer's omission or commission of a fraudulent or willful act or omission. A valid and existing policy of insurance or other contract provides coverage for the injured spouse's medical expenses. This must be established prior to filing Form 8379 in connection with the Tax Court case. The injured spouse will be awarded an additional payment for property and/or financial losses that are ancillary or in addition to the award for the injury, to be determined during a special hearing in Tax Court. If you wish to continue the lawsuit against the taxpayer for any reason, we will assist you in obtaining a judge's order that the court grant an order of the Court to pay the injured spouse a larger portion of the overpayment of tax due on his or her medical expenses. We will help you obtain a final judgment by a Tax Court Judgment Granting Injured Spouse relief. A final judgment is a final order issued by a judge that makes the taxpayer responsible for one or more debts. A final judgment grant in a tax court case allows the injured spouse to receive a final payment from the taxpayer. A final judgment also entitles the injured spouse to collect other monetary relief the court may order from the taxpayer. If you are successful in a claim for a final judgment from such a judgment, you may choose to keep any funds you have received. IRS Form 8379 Injured Spouse Relief Application Forms We offer Form 8379 as well for your consideration. This is a quick and easy application. Informed by the information provided, the form can make a positive impact on the injuries of our injured clients. Call us at or submit a form online. The IRS has released a new guidance on injured spouse relief and Form 8379. Read the IRS guidance here.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8379 Houston Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8379 Houston Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8379 Houston Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8379 Houston Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.