Award-winning PDF software

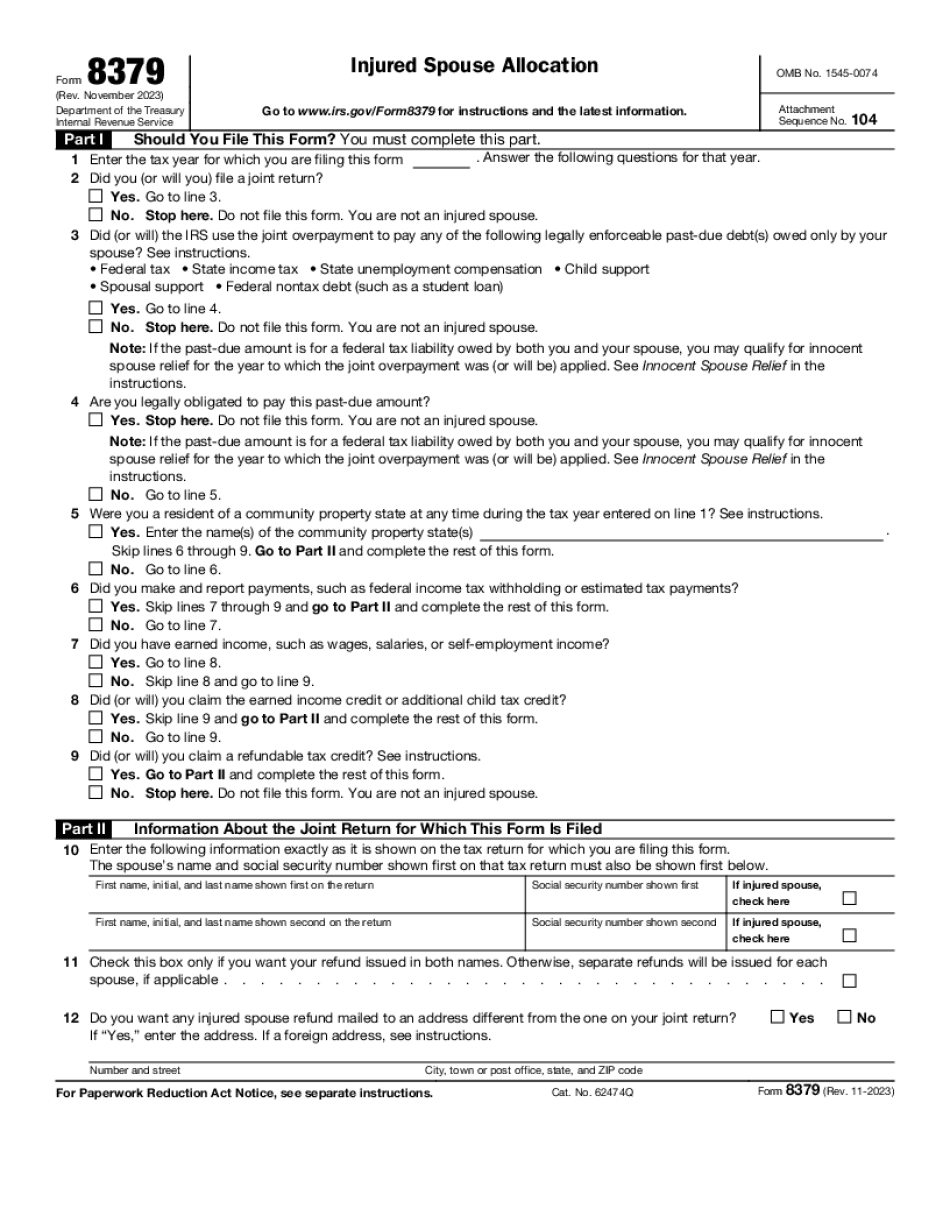

El Cajon California Form 8379: What You Should Know

This house has a 6.722 monthly water and sewer bill. Cabin/Laundry area has two sinks & faucet, sink & water heater and washer & dryer. Two cars in garage with two trucks in storage. This home was built in 1985 — and it has 2.54 acres. The previous owner and husband built this home as a multi unit. Loan to be paid from this home is 7.5 million and paid over 20 years to seller in 2009. Loan paid over to a bank in 2025 for 8.4 million. (Fees & closing costs) A loan to be paid by us. Loan will be paid over until we sell the remaining loan with interest to a bank. (Interest will then be compounded monthly and the owner will be repaid first with interest to the bank and then with cash at our closing.) Seller will be repaid the loan amount we sold to them. Interest will be compounded monthly (first 5,10,20,30 years), paid to us and returned to the bank. (Interest will be compounded monthly (first 5 years), paid to us and returned to the bank. The bank will be repaid first with interest to us and then with cash on our closing.) Interest will be compounded monthly (first 5 years), paid to us and returned to the bank, with interest compounded monthly (first 25 years), paid to us and returned to the bank, with interest compounded monthly (first 100 years) paid to us and returned to the bank. (The above is a basic example of the interest payable from this loan. This example does not include expenses such as property taxes, insurance, taxes paid to third parties such as county, city departments, etc.) If the tax refund are allocated in this manner, the first 1,000 will be apportioned on the basis of the first 6,000 of the tax refund and the remaining tax refund will be apportioned on the basis of the remaining 18,500 (taxes not allocated to one spouse are not included, but they can be allocated equally). This is an average amount and will not vary over time. For example, if the refund amount are 8,000 the first 8,000 will be apportioned equally to the injured spouse as it is equal to approximately 9.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete El Cajon California Form 8379, keep away from glitches and furnish it inside a timely method:

How to complete a El Cajon California Form 8379?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your El Cajon California Form 8379 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your El Cajon California Form 8379 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.