IRS Form 8379: Find out if you and your spouse can claim the reduced rate for

Injured Spouse Tax Rates | IRS.gov. IRS Form 8379: Find out if you and your spouse can claim the reduced rate for a spouse who sustains an extremely disabling injury or illness. Injured Spouse Benefit Calculator | IRS.gov. Find more articles like this on Dave Ramsey's site at.

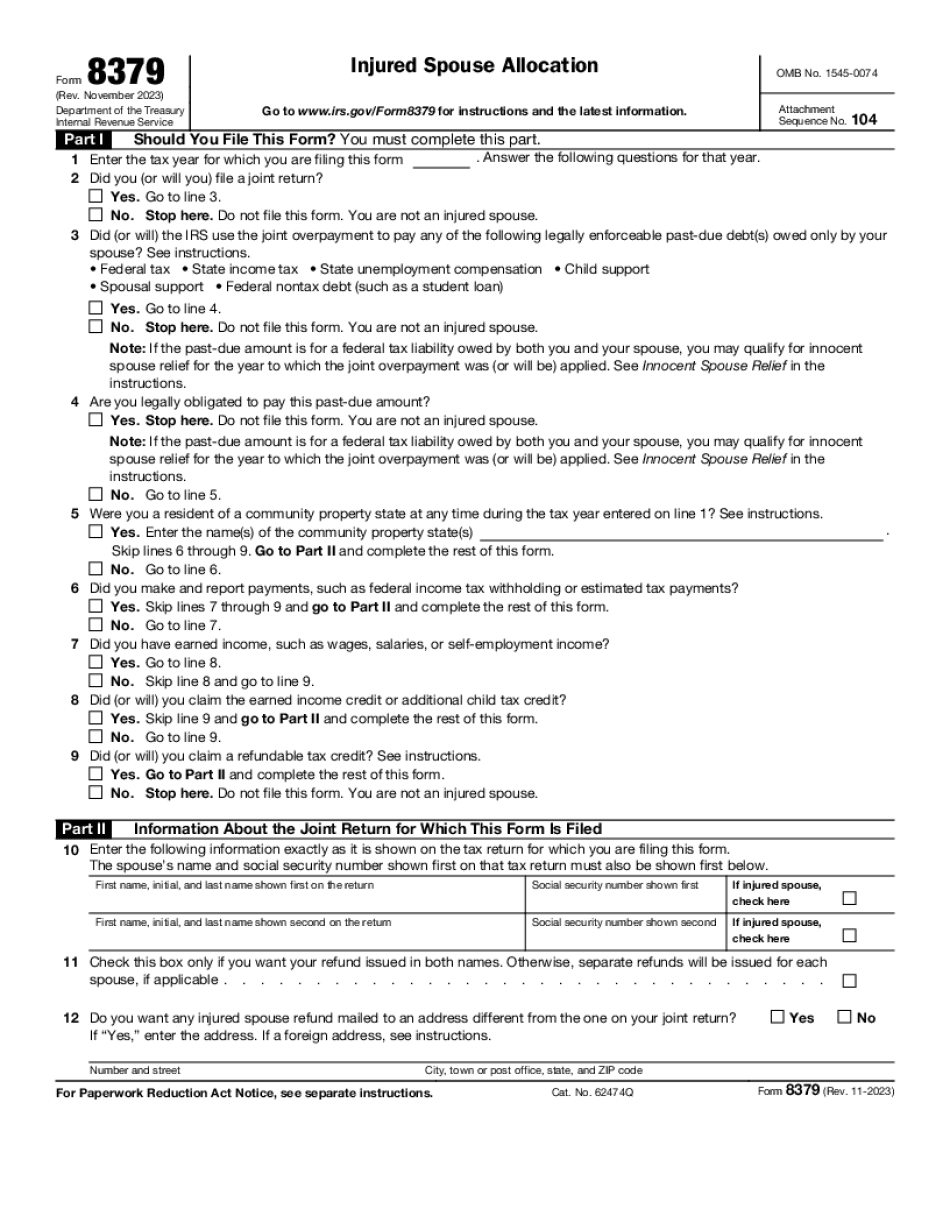

The following forms must be completed and filed separately: Form 8379 Form

An individual spouse may not claim a refund if the partner filed separate returns on the same day. You may file together or at the same time. As an exception, if all four of you file a joint return for tax year 2018, and all of you are married filing separately, you may claim the return of each of the spouses in its own separate section. The following forms must be completed and filed separately: Form 8379 Form W-4 (with EIN) Form 1040 To claim this refund, you must complete a form 8379, the Form 8379: Special Refund for Ineligible Spouses of Federal Taxpayers Form, and file it, along with supporting documentation, with the IRS. You must attach an Explanation, Statement of Facts, and Form 8379 (if requesting a single refund) or Form W-4 (with EIN) (if requesting a joint refund). You must attach your spouse's Form W-3 when claiming this exemption. Furthermore, you must file a copy of your spouse's Form W-3 if requesting a refund for each spouse. To claim the refund, you must attach Form 8849 by the date on which your spouse's Form 941 is filed. It must be filed on or before September 30 of the tax year. You must also attach supporting documents to your Form 8379 when requesting a refund. If your spouse files a separate return, file a new return on your own. If your spouse files a joint return, file a joint return with your spouse and file the other return with your own tax return. You must file your own refund, along with a separate return for your spouse, or file.

Award-winning PDF software