Hey, what's up? My YouTube would sell itself. Where's Kim Jiwon? A house? And today, I want you to listen closely. Back to back. Is now G For A B right? I was he thinking? You go where I signed up. Those who have not signed up, please hit that bell in the bottom right there, and I will notify you when I leave a video or when I upload a video. Today's video is going to be about the IRS. When you do your IRS, something just happened to me, so I want to share it with you guys. When you file your IRS jointly, make sure that your spouse or significant other, whether it's your wife or your husband or same-sex marriage, doesn't owe any back taxes or any Social Security SSI or SSDI. Because if they do, all they're going to do is take your taxes away from you. And you're going to have to fill out form 83-79 to amend it. That's just what happened to me. My wife also had some back pay that was from her childhood and from her dad, who passed away. There was an overpayment, and I wasn't aware of it, so they took money away from me. I had to do what is called an injured spouse, right. An injured spouse has to fill out two forms, form 83-79. You can do it online, or you can do it when you do your taxes. After you finish, you have to put in for me and attach form 83-79. But remember, if you do that, then it will come out of your job, your refund. Here in New York, child support takes away from you. When it's done joining, they keep it there for six months. After the six months, they...

Award-winning PDF software

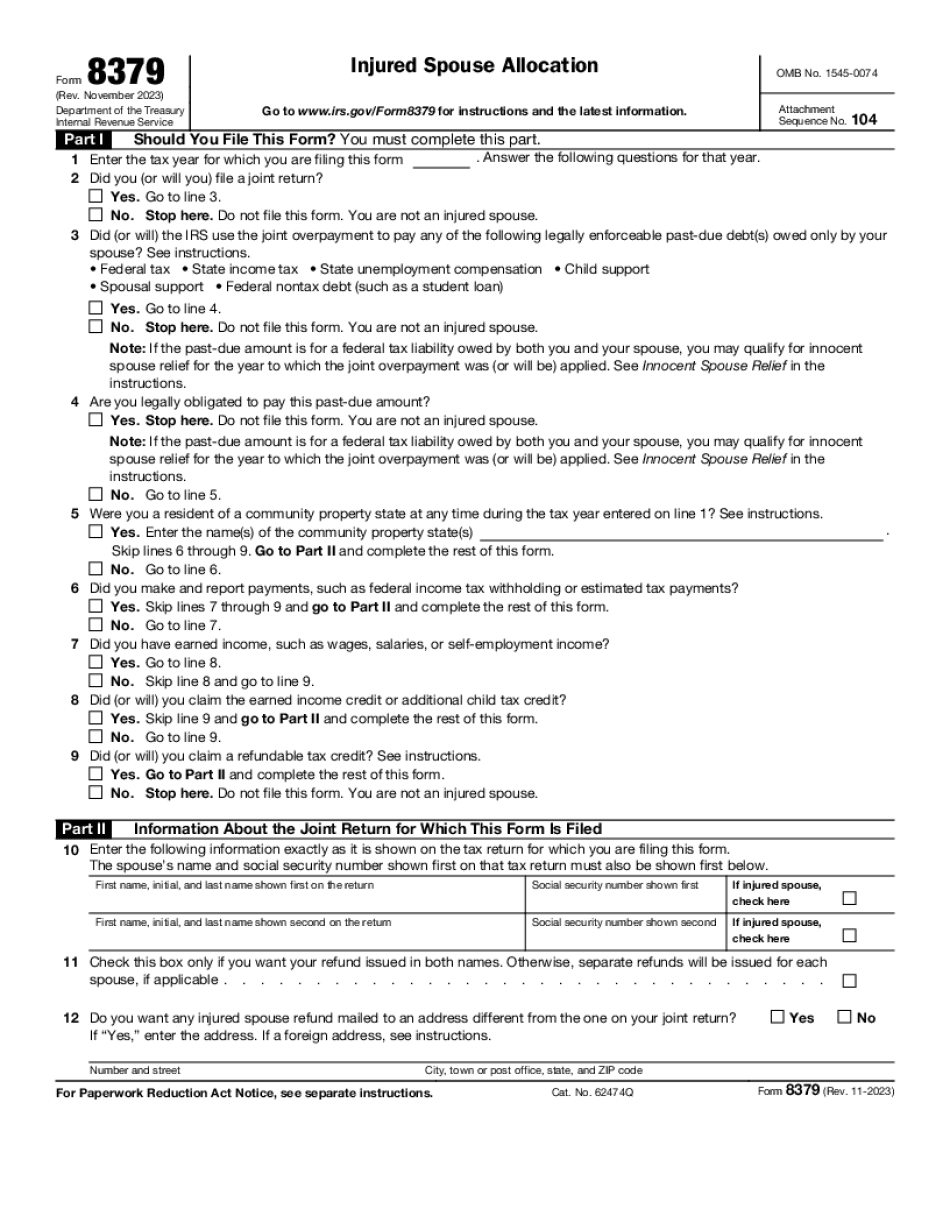

Free fillable 8379 Form: What You Should Know

Form 8379, Tax Claimant's Claim Information Provide the name the claimant and their Social Security number.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8379, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8379 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8379 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8379 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Free fillable Form 8379